The world is facing the urgent challenge of climate change. In response, carbon pricing has emerged as a pivotal tool in reducing greenhouse gas emissions. Among various carbon pricing mechanisms, carbon taxes are particularly notable for their straightforward and transparent approach to incentivizing emission reductions. This blog post explores carbon tax policies in Europe. It examines successful examples from leading nations. The goal is to understand their impact and potential lessons for other regions.

Understanding Carbon Pricing Mechanisms: A Brief Overview

Carbon pricing mechanisms are frameworks that assign a cost to emitting carbon dioxide (CO2) and other greenhouse gases. These mechanisms place a monetary value on emissions. They aim to internalize the environmental costs of fossil fuel use. This approach encourages businesses and individuals to adopt cleaner alternatives. Among these mechanisms, carbon taxes directly levy charges based on the amount of emissions produced. Cap-and-trade systems set a limit on total allowable emissions and allow trading of emission permits.

The Role of Carbon Tax Policies in Climate Action

Carbon tax policies play a crucial role in climate action by creating financial incentives for reducing emissions. They encourage investment in renewable energy, promote energy efficiency, and drive innovation in low-carbon technologies. Carbon taxes ensure that polluters pay for the environmental costs of their activities. This can shift consumption patterns toward more sustainable practices.

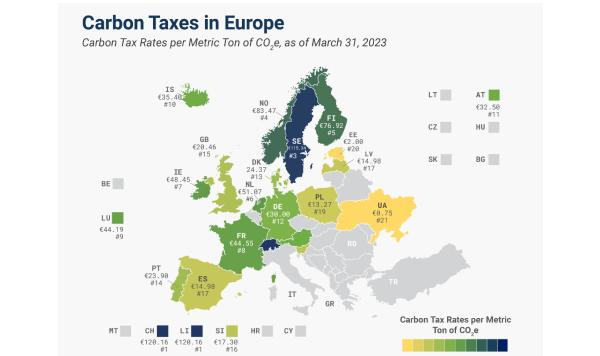

Why Europe Leads the Way in Carbon Pricing

Europe is often hailed as a leader in carbon pricing. With a strong commitment to climate goals, European countries have implemented various carbon pricing mechanisms since the 1990s. The EU’s overarching climate policies emphasize Europe’s proactive approach. Individual national strategies further support combating climate change with effective pricing mechanisms.

Historical Context of Carbon Tax in Europe

The Evolution of Carbon Tax Policies Across the Continent

The journey of carbon taxes in Europe began earnestly in the early 1990s, primarily with Sweden as a frontrunner. Over the decades, other nations have adapted and innovated their own policies, creating a diverse landscape of carbon taxation strategies.

Key Milestones and Policy Shifts Over the Decades

Key milestones include the introduction of Sweden’s carbon tax in 1991. France followed with its carbon tax in 2014. The UK’s Carbon Reduction Commitment was introduced in 2010. Each of these policies marked significant shifts in how countries viewed carbon emissions and climate responsibility.

The Impact of Early Adopters on European Climate Strategies

Countries that adopted carbon taxes early demonstrated their effectiveness in reducing emissions and stimulating economic shifts. The initial success of these policies has inspired other nations. It has also contributed to the broader acceptance of carbon pricing as a viable climate policy.

Case Study: Sweden’s Carbon Tax Success

How Sweden Pioneered Carbon Tax Implementation

Sweden’s carbon tax, initially set at a high rate, was designed to fundamentally change energy consumption patterns. It was paired with reductions in other taxes to maintain economic balance, making it politically feasible and economically beneficial.

The Economic and Environmental Outcomes of Sweden’s Approach

As a result, Sweden has reduced its emissions significantly while enjoying robust economic growth. The transparency and predictability of the tax helped foster public trust and compliance, proving effective in promoting cleaner energy sources.

Lessons Learned from Sweden’s Model for Other Nations

Sweden’s model underscores the importance of setting ambitious yet clear carbon pricing levels. It also emphasizes coupling them with complementary policies. These include renewable energy incentives and social equity considerations.

The United Kingdom’s Carbon Pricing Journey

From the Carbon Reduction Commitment to the Carbon Price Support

In the UK, the transition from the Carbon Reduction Commitment to the Carbon Price Support marked a pivotal moment. This change was significant in the country’s carbon pricing strategy. The UK has integrated carbon pricing with its broader energy policies to effectively reduce emissions across sectors.

Evaluating the Effectiveness of the UK’s Carbon Pricing Mechanisms

While the UK has seen substantial decreases in greenhouse gas emissions, challenges remain in maintaining competitiveness within carbon-intensive industries. Ongoing adjustments in policy ensure that carbon pricing remains effective in achieving climate targets.

Challenges and Achievements in the UK’s Carbon Tax Policy

The UK’s approach reveals a complex balancing act between achieving environmental goals and supporting economic growth. Nevertheless, it continues to serve as a strong example of adaptive carbon pricing.

France and Its Carbon Tax Innovations

Analyzing France’s Approach to Carbon Taxation and Climate Goals

France implemented its carbon tax in 2014 to align with its climate goals under the Paris Agreement. Although initially met with resistance, the tax was designed to gradually increase, providing businesses and consumers time to adjust.

The Role of France’s Carbon Tax in Shaping EU Policy

France’s carbon tax has influenced broader EU negotiations, driving discussions on cohesive and effective emission reduction strategies across member states.

Public and Political Reactions to France’s Tax Measures

Public unrest surrounding the tax highlights the importance of addressing social equity concerns in carbon pricing policies. Engaging stakeholders and communicating the long-term benefits remains vital for public acceptance.

Germany’s Cap-and-Trade and Carbon Tax Integration

How Germany Combines Cap-and-Trade Systems with Carbon Taxation

Germany’s approach integrates a cap-and-trade system with carbon taxation. This provides a dual framework for reducing emissions. It also promotes renewable energy investments.

The Impact on Germany’s Industrial Sector and Green Energy Investments

This integration has successfully driven down emissions in the industrial sector. It has increased investments in green energy. It showcases a balanced approach to economic and environmental needs.

Future Directions for Germany’s Carbon Pricing Strategies

As renewable energy sources become more prevalent, Germany must continue adjusting its carbon pricing framework. This ensures continued effectiveness in driving down emissions.

Comparative Analysis: Key Differences and Similarities

Comparing Carbon Tax Policies: Sweden, UK, France, and Germany

While Sweden’s carbon tax remains the benchmark for effectiveness, each country’s unique socio-political context shapes its approach to carbon pricing. The UK emphasizes flexibility, France integrates public consensus, and Germany innovates through system integration.

The Effectiveness of Different Approaches in Achieving Climate Targets

This comparative analysis shows that no one-size-fits-all solution exists. Instead, a combination of tailored strategies aligned with national interests has proven effective.

Insights for Other Countries Considering Carbon Tax Policies

Emerging economies can learn from these European models. They can adapt principles that resonate with their regulatory and economic frameworks. This approach ensures public buy-in and effective implementation.

Future Outlook and Recommendations

Emerging Trends in Carbon Pricing Across Europe

As climate urgency grows, many European nations are refining their carbon pricing mechanisms. They aim to further integrate climate policies with economic incentives.

How Recent Policy Changes May Influence Future Carbon Tax Strategies

Recent breakthroughs, such as the Green Deal, may lead to more harmonized carbon pricing across the EU. This could enable more cohesive climate action.

Recommendations for Improving Carbon Tax Policies Based on European Examples

Future carbon pricing strategies should prioritize transparency, public engagement, and integration with broader sustainability goals to maximize acceptance and effectiveness.

Leave a Reply