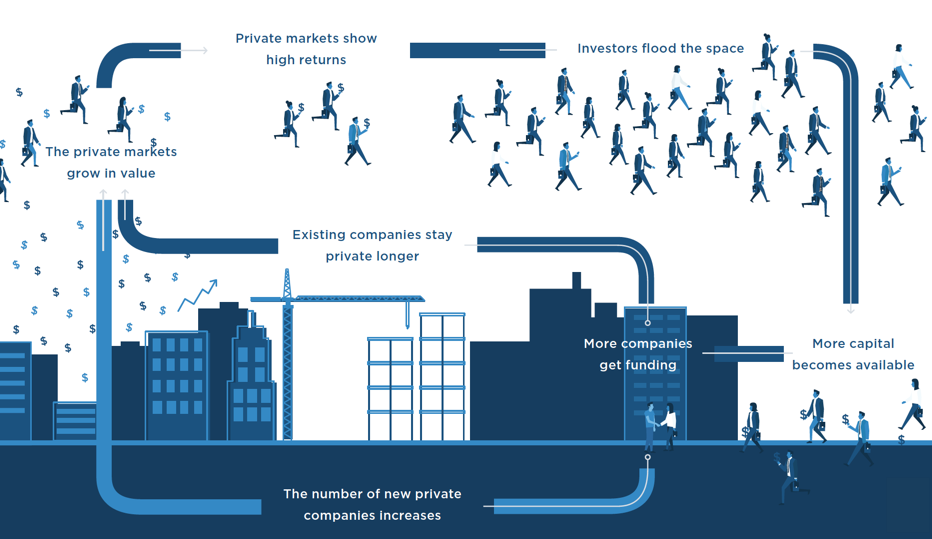

Record Growth in Private Markets

The private equity (PE) and venture capital (VC) sectors are experiencing unprecedented growth. This growth is driven by record levels of unspent capital, often referred to as “dry powder.” This surplus has enabled PE firms to increasingly target mid-market companies, which are seen as ripe for value creation. Meanwhile, venture capital continues to pour into high-potential sectors such as fintech, biotech, and clean energy. These industries have been identified as critical areas for innovation, attracting significant investor interest.

The Decline of SPACs Amid Regulatory Scrutiny

Special Purpose Acquisition Companies (SPACs), once hailed as a revolutionary way for companies to go public, have lost momentum. This decline has been attributed to increased regulatory scrutiny and underwhelming performance post-listing. As a result, alternative methods, such as direct listings, have gained traction. These approaches are seen as more transparent. They are considered cost-effective ways for companies to enter public markets. This avoids the complexities associated with traditional IPOs or SPAC mergers.

The Unicorn Phenomenon Under Pressure

Despite ongoing market volatility, privately held “unicorns”—startups valued at over $1 billion—continue to dominate headlines. However, many of these companies are facing downward pressure on valuations as funding becomes scarcer. Investors are now adopting a more cautious approach, demanding higher accountability and sustainable business models from these high-value startups. This shift indicates a major recalibration within the venture capital ecosystem. Profitability is starting to outweigh rapid growth as a priority.

Mid-Market Companies: A Sweet Spot for PE Firms

Private equity firms are increasingly focusing on mid-market companies, which are being targeted for their growth potential and operational efficiencies. These companies are often overlooked by larger institutional investors. They represent an opportunity for PE firms to create significant value through strategic investments. PE firms leverage their expertise in operational improvements. They focus on financial restructuring. This transforms mid-market businesses into profitable enterprises. As a result, it further fuels the growth of the private markets.

Sectors Driving Venture Capital Investment

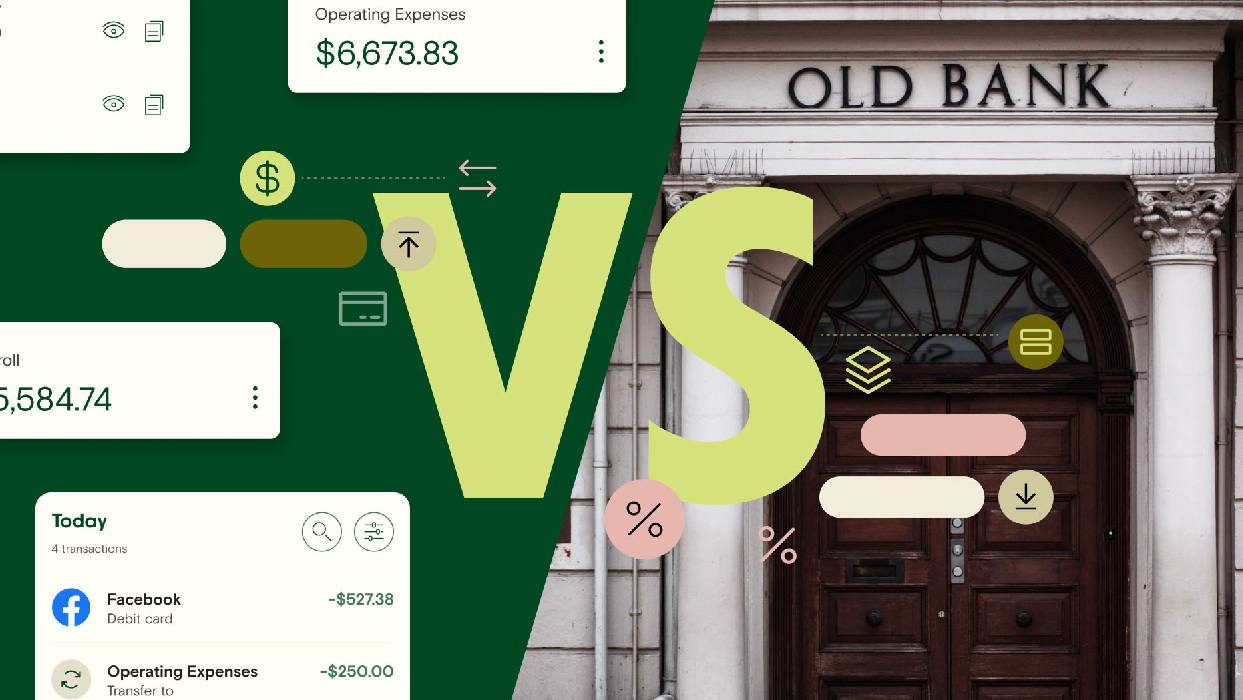

Venture capital investment is heavily concentrated in sectors like fintech, biotech, and clean energy, where innovation is reshaping industries. Fintech startups are revolutionizing banking and payments, while biotech companies are advancing breakthroughs in healthcare. Similarly, clean energy ventures are addressing global climate challenges, making them attractive to impact-driven investors. These sectors are not only driving economic growth. They are also positioning themselves as leaders in addressing some of the world’s most pressing issues.

The Future of Private Markets Amid Challenges

The private equity boom shows no signs of slowing. Venture capital is also continuing its rapid growth. However, challenges remain. Market volatility, tighter funding conditions, and evolving regulations are forcing investors to adapt. Nevertheless, the resilience of private markets, coupled with their ability to innovate and deliver strong returns, ensures their continued dominance. As new investment strategies appear, private equity and venture capital will likely stay at the forefront of global economic transformation. Industries will continue to evolve.

Leave a Reply