Jerome Powell’s words have become synonymous with market movements. He is the Chairman of the American Federal Reserve (Fed). His words particularly influence the realm of precious metals. As central bankers congregated for the annual Jackson Hole Economic Symposium in Wyoming on August 22, anticipation surged around Mr. Powell’s address, making it a substantial focal point for investors globally.

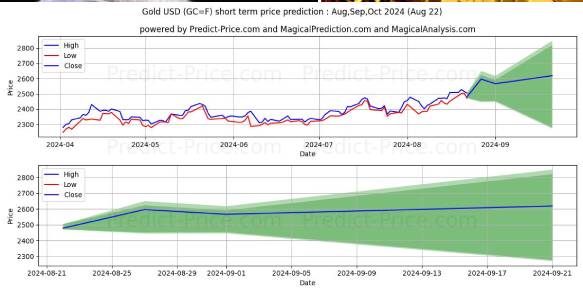

Leading up to this pivotal moment, gold prices surged dramatically. By August 19, the price of gold crossed the symbolic threshold of 2,500 pounce. On August 20, it closed at 2,514, even reaching a session high of over 2,530. This unprecedented fervor was, however, slightly tempered in the days that followed. Yet, on August 23—on the day of Powell’s speech—gold hit 2,500, showcasing a remarkable increase of more than 20% compared to its price at the beginning of January.

A Trend Rooted in Expectations

The dramatic rise of gold began its trajectory in late 2023. It was characterized by a captivating ascent. This rise resonated with investors. This trend is particularly driven by Powell’s remarks and the surrounding anticipation regarding future monetary policies. A central theme has emerged. Speculation surrounds a potential decline in interest rates. This introduces a myriad of possible scenarios influencing investor sentiment.

In his speech, Powell articulated, “The time has come for a monetary policy adjustment.” He effectively signaled the possibility of a rate cut during the Fed’s next meeting. This meeting is scheduled for September 17 and 18. This announcement had immediate repercussions for the gold market. It also led to a notable depreciation of the U.S. dollar. Anticipated lower interest rates fundamentally support gold prices. The yellow metal does not yield interest. Lower rates amplify its attractiveness.

Analysts, including Saxobank’s Ole Hansen, emphasize that a weaker dollar enhances gold’s appeal. Decreasing Treasury yields contribute to this effect as well. Together, these factors continue to bolster gold’s standing as a safe haven asset. Traditionally, investors regard gold as an alternative to interest-bearing assets. In an environment of falling interest rates, gold becomes increasingly appealing. This change reinforces its allure among investors seeking stability in turbulent times.

The Broader Implications

The implications of this trend extend beyond mere pricing dynamics. For investors, monetary policy shifts play a crucial role. This is especially true for those in the commodities and precious metals markets. These shifts set the tone for strategic decision-making. Powell and the Fed are navigating the delicate balance of economic growth, inflation, and market expectations. In this context, gold’s role as a fundamental asset becomes more pronounced.

In conclusion, as the dust settles from Powell’s address, market reactions continue to unfold. The trajectory of gold remains a significant barometer of financial sentiment. The interplay of Powell’s guidance and investor expectations will likely dictate the future path of not only gold prices but also the overall economic landscape. Moving forward, staying attuned to these developments is crucial. Understanding their broader implications will be essential for informed investment decisions in the months ahead.

Leave a Reply