As global financial systems stabilize, the balance between short-term calm and growing medium-term vulnerabilities poses significant challenges. Financial experts Tobias Adrian, Shahriar Malik, and Jason Wu provided insights as of October 21, 2024. They underline critical concerns despite recent improvements in the global economic outlook.

Central banks’ efforts to curb inflation have led to lower interest rates, boosting asset prices and reducing market volatility. While this creates optimism for a potential soft economic landing, the Global Financial Stability Report warns of escalating risks. Two critical factors stand out:

- Exacerbated Financial Vulnerabilities: Eased financial conditions have amplified vulnerabilities. These include inflated asset prices, rising debt levels, and increased leverage by institutions. These trends echo patterns seen before the 2008 financial crisis. They highlight the gradual buildup of risks. These risks demand immediate attention from policymakers.

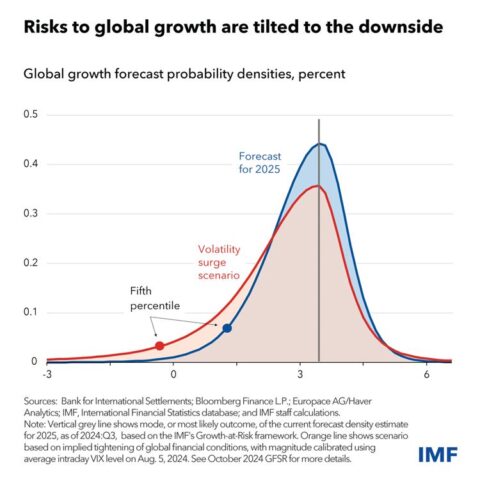

- Geopolitical Uncertainty vs. Market Calm: A stark disconnect between heightened geopolitical tensions and low market volatility suggests financial markets may not fully price in risks from ongoing conflicts and trade disputes. This mismatch raises the likelihood of future market shocks, as geopolitical developments could rapidly trigger sell-offs and volatility spikes.

For instance, market disruptions in August underscored these risks. A sharp yen appreciation, driven by shifts in U.S.-Japan interest rate differentials and disappointing U.S. wage data, led to sudden sell-offs in equity markets. The turbulence revealed the fragility of investor sentiment, although the pressures were temporary and did not destabilize broader financial systems.

The key takeaway is clear: while short-term financial stability is promising, vulnerabilities could worsen without proactive measures. Policymakers must prioritize addressing debt imbalances, monitoring geopolitical risks, and fostering resilience in interconnected global markets.

Leave a Reply